Jacob Kirkegaard

Former Senior FellowJacob Kirkegaard is a former Senior Fellow at GMF.

Media Mentions

Featured Work

Image

June 19, 2024

The European Parliament election on June 6-9 saw overall gains for right-of-center parties without a feared surge toward the far right. Across...

Image

June 4, 2024

More than half of Ukraine’s power production capacity has been damaged by Russia since February 2022. Reconstruction is already underway, but to meet...

Image

April 12, 2024

The scale of the challenges has pushed the EU Commission to identify what it will take for the bloc to remain competitive....

Image

March 6, 2024

Immigration is once again at the top of many European voters’ agenda in this parliamentary election year. EU policymakers are racing to reform asylum...

Image

Image

May 22, 2023

Image

February 16, 2023

Anniversaries should be celebratory, but some are painful remembrances of events that elicited profound change. ...

Image

Image

February 1, 2023

Image

October 13, 2022

With Ukraine’s Kharkiv and Kherson offensives potentially shortening the war, the challenge of the country’s reconstruction has come to the fore,...

Image

Image

April 19, 2022

The return of wars of annihilation in Europe with Russia’s brutal assault on Ukraine poses life-and-death questions for the European Union, its...

Image

Image

March 3, 2022

Russia’s invasion of Ukraine has been met with a unified Western response and an escalating set of powerful economic sanctions. ...

Image

Image

Image

Image

Image

June 15, 2021

The message seems to have been heard loud and clear, with European Council President Charles Michel saying America is back on "the global scene"....

Image

June 3, 2021

In an interview for German magazine CAPITAL, GMF Senior Fellow Jacob Kirkegaard discussed U.S. President Joe Biden’s move to withdraw drilling rights...

Image

April 30, 2021

In an interview for German magazine CAPITAL, GMF Senior Fellow Jacob Kirkegaard discussed U.S. President Joe Biden’s 100 days in office. He noted that...

Image

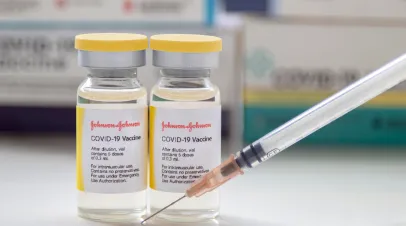

April 14, 2021

Johnson & Johnson’s decision to temporarily suspend distribution to the European Union while it conducts a review on blood clots adds pressure on...

Image

February 24, 2021

GMF Senior Fellow Jacob Kirkegaard sat down for an interview with Belgian Public Broadcaster VRT for their “Terzake” show to discuss the vaccine...

Image

January 29, 2021

Image

January 28, 2021

The European Union is facing an accelerating health, economic, and political crisis because of the continent’s persistent failure to vaccinate its...

Image

Image

October 16, 2020

The European Covid-19 policy response has created the largest commonly funded European crisis fighting tools in EU history....

Image

The election of Joe Biden will put a committed transatlanticist in the White House. No longer viewed as a hostile entity, the European Union can...

Image

This is part of our series on the policy implications of the 2020 U.S. elections for U.S....